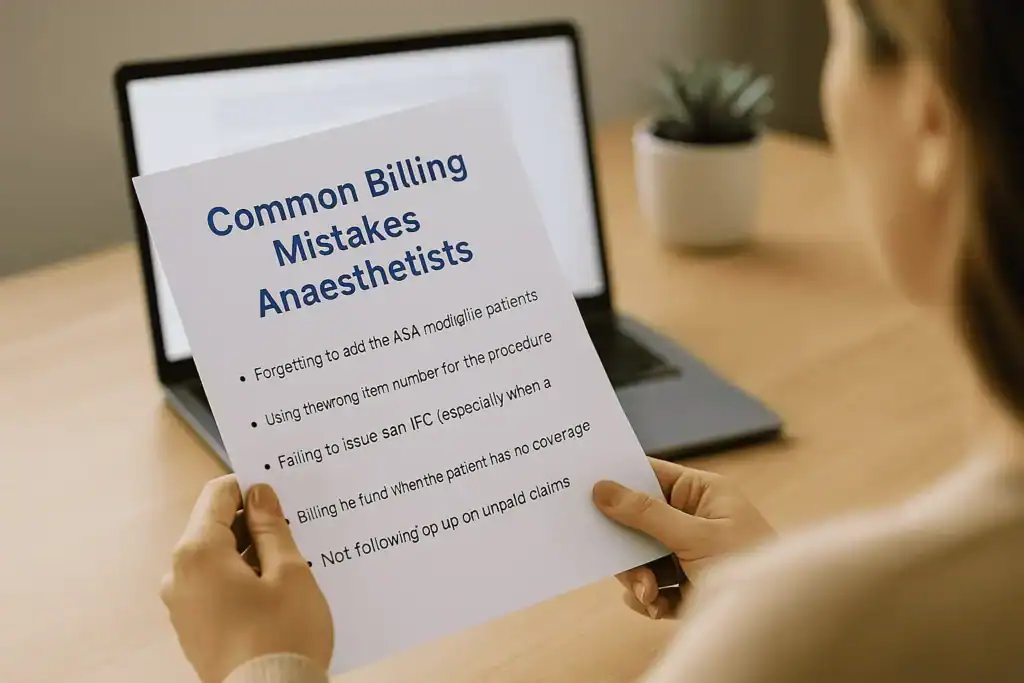

Common Billing Mistakes Anaesthetists Should Avoid

Anaesthetic billing in Australia can be complicated, even for experienced practitioners. Between navigating MBS item numbers, health fund policies, patient documentation, and ever-evolving compliance requirements, it’s no surprise that billing errors are common. This article explores the common billing mistakes anaesthetists face and offers simple solutions to help avoid them.

Whether you manage billing yourself or through an agency, understanding where problems occur helps ensure your billing is accurate, compliant, and stress-free.

Incorrect MBS or RVG Item Coding

The foundation of any anaesthetic bill is the item number. Using the wrong MBS (Medicare Benefits Schedule) or RVG (Relative Value Guide) code can lead to serious consequences, including claim rejections or reduced reimbursements.

How to avoid it:

- Cross-check the surgeon’s item number with the appropriate anaesthetic code.

- Always refer to the latest MBS guidelines or your billing software’s live updates.

- Be cautious with similar procedures that require different codes based on complexity or site.

Omitting Patient Information

Even the most carefully coded bill can be denied if key patient details are missing or incorrect. This includes full name, date of birth, Medicare number, and health fund policy.

How to avoid it:

- Double-check patient intake forms for errors.

- Use software that validates health fund details against real-time eligibility checks.

- If your admin or receptionist is handling this, consider a checklist to confirm accuracy before submission.

Incomplete Clinical Documentation

The documentation you write during or after a case is the evidence used to justify the claim. If details are vague, incomplete, or inconsistent, you risk delayed or denied payments.

How to avoid it:

- Record start and finish times clearly.

- Document ASA classification and reasoning.

- Note any special monitoring, techniques, or complications.

- Keep records legible and timely.

Unverified or Incorrect Use of Modifiers

Billing modifiers account for things like patient complexity, monitoring, or emergency care. Using them incorrectly can trigger audits or lead to underpayment.

How to avoid it:

- Know when ASA scores justify an extra unit (ASA 3 or 4).

- Don’t overuse modifiers unless clearly documented.

- Ensure your notes align with modifier selection.

Billing for Non-Covered Services

Some health funds won’t cover specific items or combinations unless strict rules are followed. Billing without verifying coverage can frustrate patients and result in unpaid accounts.

How to avoid it:

- Verify fund coverage for complex or uncommon procedures.

- Inform the patient ahead of time if a fee will apply.

- Include disclaimers in your IFC (Informed Financial Consent) when uncertainty exists.

Duplicate Billing is a Common Billing Mistakes Anaesthetists Should Avoid

Duplicate billing is one of the common billing mistakes anaesthetists make when managing multiple systems or hospital sites.

It’s easier than you’d think to accidentally bill the same case twice—especially if you operate across hospitals or use multiple systems.

How to avoid it:

- Keep a case log separate from billing records.

- Run monthly reports to identify duplicates.

- Use software that flags identical time stamps or procedure entries.

Errors in Time Unit Calculation

Time-based billing is central to anaesthesia invoicing. Every 15 minutes equals a unit. Overestimating or underestimating time can affect compliance and income.

How to avoid it:

- Always record the anaesthetic start (pre-oxygenation) and finish time.

- Round only as per Medicare guidelines.

- Keep copies of anaesthetic charts for audit readiness.

Mismatched Provider Information

If your provider number or name doesn’t match what the fund or Medicare has on record, your claim may be delayed or rejected.

How to avoid it:

- Confirm you are registered with all health funds you bill.

- Maintain consistent formatting of your provider name (e.g., middle initials).

- Notify funds immediately of address or contact changes.

Failure to Follow Up on Denied or Unpaid Claims

This is one of the most financially damaging mistakes. Many anaesthetists simply don’t have the time to chase denied claims.

How to avoid it:

- Set a weekly reminder to review outstanding claims.

- Use software or a billing service that flags rejections.

- Persist. Many denials are reversed once supporting documentation is submitted.

Not Keeping Up with Policy Changes

Medicare and health fund rules change regularly. A code that was valid six months ago might now require extra documentation or be deactivated.

How to avoid it:

- Subscribe to MBS and AMA updates.

- Attend billing webinars and updates from your billing provider.

- Review your item lists every quarter.

Inaccurate Fee Estimates

Underquoting in your informed financial consent leads to patient frustration. Overquoting may cause patients to cancel. Fee transparency is more important than ever.

How to avoid it:

- Use a central fee schedule template for all procedures.

- Factor in ASA, time units, and modifiers when estimating.

- List any potential variables that may affect final cost.

Lack of Regular Reviews or Audits

Even small mistakes repeated over time can result in major financial loss or regulatory trouble.

How to avoid it:

- Conduct internal billing reviews quarterly.

- Compare billed amounts vs received.

- Consider an external audit every 12–24 months.

Final Thoughts

Final Thoughts

If you’re wondering how to bill for anaesthetic services accurately, avoiding these common billing mistakes anaesthetists encounter is a strong place to start. Billing correctly isn’t just about getting paid—it’s about protecting your practice, your patient relationships, and your peace of mind.

At Fast Tracking Anaesthetic Billing Services, we help anaesthetists across Australia reduce errors, improve cash flow, and stay compliant with ever-changing rules.

Need help fixing your billing process?

Contact us for a free 10-minute billing consultation today.

🔗 External Reference: Medicare Benefits Schedule